Image

Inside the Oregon capitol building.Ben Botkin/The Lund Report

Image

SCREENSHOT OF OREGON HEALTH INSURANCE MARKETPLACE WEBSITE.

Image

SHUTTERSTOCK

Image

SHUTTERSTOCK

Image

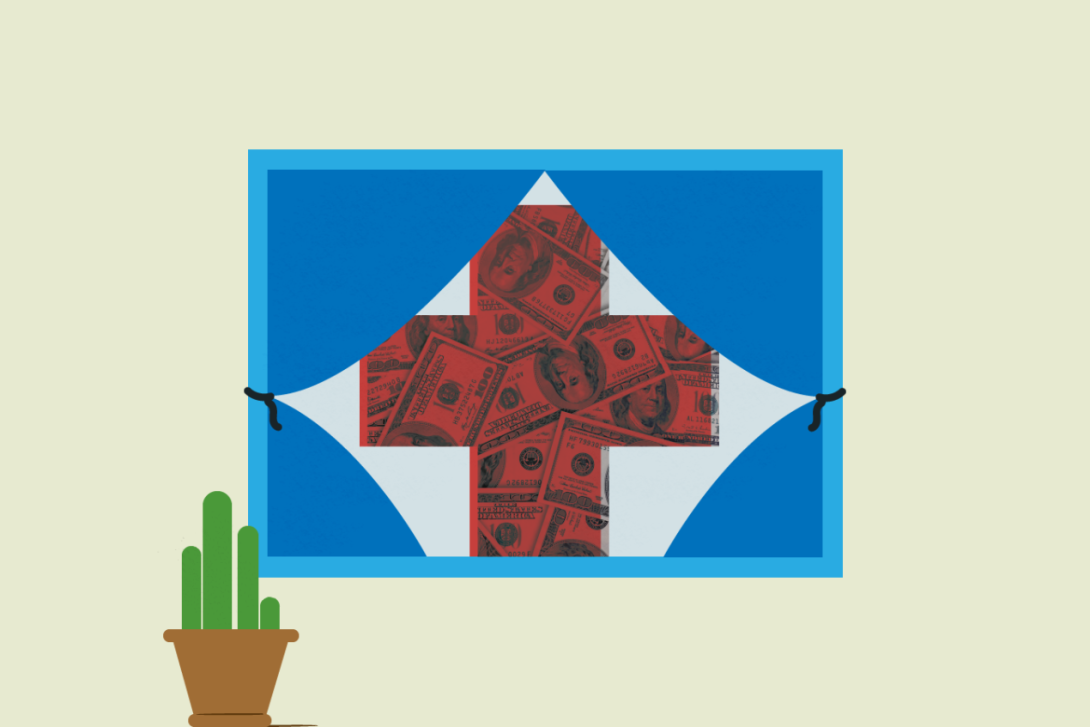

Illustration by Kaiser Health News

Image

SHUTTERSTOCK

Image

SHUTTERSTOCK

Image

MUFID MAJNUN ON UNSPLASH

Image

Humana sells health insurance across the U.S. including from this location in Louisville, Kentucky./Shutterstock

Image

SHUTTERSTOCK