Image

Pharmacist Jeanne Mendazona and her staff at Hometown Drugs can barely keep up with all the new prescriptions since Bi-Mart closed its pharmacy in Madras. That doesn't mean more money. The big companies are squeezing the profits out of small-town drug stores.

|

PAT KRUIS/PAMPLIN MEDIA GROUP

Image

A still from a Milwaukie police officer’s body camera shows the inside of Providence Milwaukie Hospital prior to the death of Jean Descamps on Dec. 12.

|

PAMPLIN MEDIA GROUP SCREENSHOT USED WITH PERMISSION

Image

From a wide-angle view, most of a single-occupancy unit at the Joyce can be seen.

|

COPYRIGHT PAMPLIN MEDIA GROUP/ANNA DEL SAVIO/USED WITH PERMISSION

Image

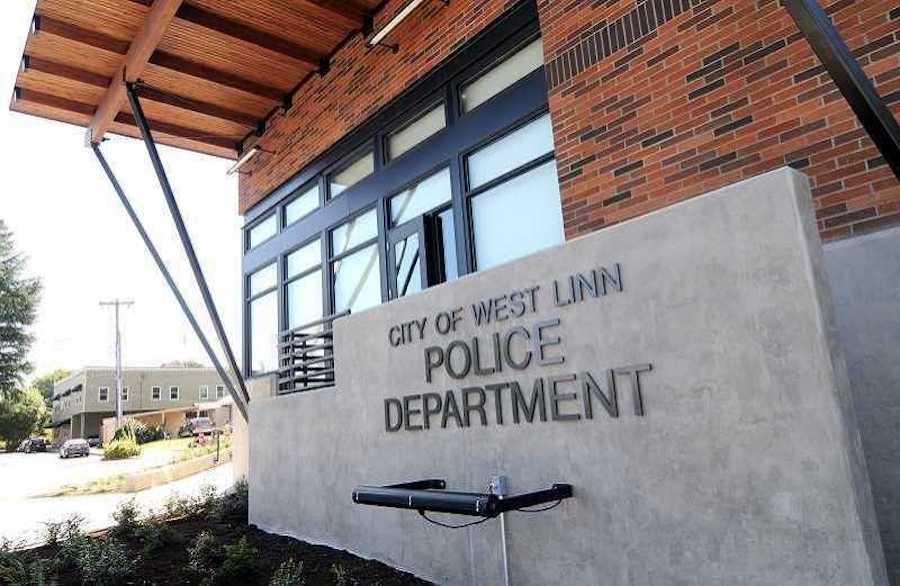

Patients of former West Linn doctor David Farley say Detective Tony Christensen of West Linn Police Department handled their case poorly.

|

PHOTO COPYRIGHT: PAMPLIN MEDIA GROUP (USED WITH PERMISSION).

Image

Patients of former West Linn doctor David Farley say Detective Tony Christensen of West Linn Police Department handled their case poorly.

|

PHOTO COPYRIGHT: PAMPLIN MEDIA GROUP (USED WITH PERMISSION).

Image

U.S. Sen. Ron Wyden at the Oregon Convention Center in Portland in 2016.

|

SHUTTERSTOCK

Image

Oregon State Capitol in Salem.

|

BEN BOTKIN/THE LUND REPORT

Image

AN AERIAL VIEW OF THE 7.7 ACRE PLOT OF FARMLAND WHERE NW BIBLE TRAINING OPERATES./CLACKAMAS COUNTY PLANNING AND ZONING DIVISIN/PMG PHOTO

Image

Rep. Kurt Schrader, from left, Clackamas Voliunteers in Medicine Medical Director Dr. Anna Tubman and Clackamas Community College President Dr. Tim Cook at the site of the new clinic./Jaelen Ogadhoh/Pamplin Media Group

Image

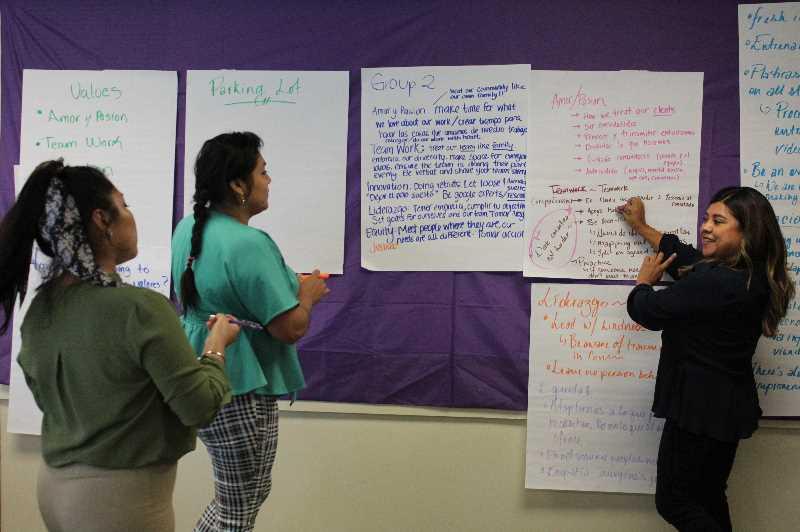

Staff at the Latino Health Coalition in Southwest Portland in August 2021.

|

COURTNEY VAUGHN/©PMG/REPUBLISHED WITH PERMISSION FROM PAMPLIN MEDIA GROUP