In what could be a sign of Oregon’s improving economy, the number of people obtaining healthcare through Medicaid-funded coordinated care organizations dropped precipitously in the first nine months of 2016, according to financial reports analyzed by The Lund Report.

Fifteen of the state’s 16 CCOs covered fewer people in the third quarter of last year than in the first quarter of that year, with only Eastern Oregon CCO seeing an uptick in its membership. An average of 893,702 people in the state were enrolled in CCOs in the third quarter, down by 60,956 people from the first quarter of the year.

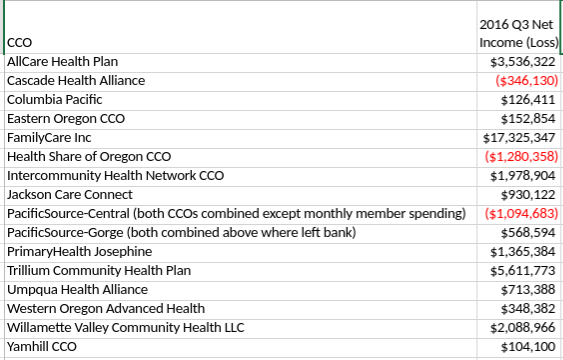

Click here for a spreadsheet that highlights key financial metrics for the state's CCOs.

Fourth-quarter and full-year 2016 CCO finances are not yet available, and it’s likely to be several months before they are released. Last year, the audited 2015 reports for these organizations were published by the state in May.

Here’s an up-close look at some of what the third-quarter financial documents reveal.

AllCare Health Plan

AllCare started as a for-profit physician owned-Medicaid plan in 1996, and was chosen in 2012 to operate as a CCO serving a number of communities in southern Oregon. Based in Grants Pass, it serves Jackson, Josephine and Curry counties, as well as southern Douglas County.

The CCO reported a $3 million dividend or distribution to its owners in the third quarter, after making no such payments earlier in the year. It received an $8.6 million quality incentive pool payment in the second-quarter of the year.

By the numbers:

- Third quarter 2016 net income: $5,902,702.

- Average monthly medical spending per member: $310.

- Average members: 49,857.

- Days of cash on hand: 52.

Cascade Health Alliance

Cascade Health Alliance is Klamath County’s CCO. A for-profit, it is a subsidiary of Cascade Comprehensive Care, which is comprised of a network of hospitals, doctors and clinics. CCC also administers the ATRIO Medicare health plans.

The CCO did not make any dividend or distribution payments through the first nine months of 2016. It received a $1.9 million quality incentive pool payment in the second-quarter of the year.

By the numbers:

- Third quarter 2016 net loss: $582,713.

- Average monthly medical spending per member: $415.

- Average members: 15,455.

- Days of cash on hand: 62.

Columbia Pacific

Columbia Pacific CCO is a nonprofit that serves Clatsop, Columbia and Tillamook counties.

The CCO did not make any dividend or distribution payments through the first nine months of 2016. It paid $105,131 into the state’s quality incentive pool in the second-quarter of the year.

By the numbers:

- Third quarter 2016 net income: $47,105.

- Average monthly medical spending per member: $397.

- Average members: 25,426.

- Days of cash on hand: 40.

Eastern Oregon CCO

Formed in May 2012, Eastern Oregon CCO is owned half by ODS Community Health (a Moda Health Plan subsidiary) and half by Greater Oregon Behavioral Health Inc., and serves Medicaid members in 12 counties in eastern Oregon. It is administered by GOBHI.

Eastern Oregon is the only CCO in the state to report a rise in membership in the third quarter, when it averaged 52,254 members – up from 48,500 members in the second quarter of 2016, and 49053 in the first quarter. Some of that may reflect higher poverty rates and unemployment challenges in rural areas of the state. But the counties this CCO serves do not all report unemployment rates higher than other rural counties, so it’s not entirely clear why Eastern Oregon CCO’s membership climbed while all other CCOs saw their membership decline.

The CCO reported a $20 million dividend or distribution to its owners in the third quarter, after making no such payments earlier in the year. It received a $10.2 million quality incentive pool payment in the second-quarter of the year.

By the numbers:

- Third quarter 2016 net income: $77,466.

- Average monthly medical spending per member: $385.

- Average members: 52,254.

- Days of cash on hand: 56.

FamilyCare

FamilyCare Inc. is a nonprofit whose roots go back to 1984. In addition to running a CCO that serves Clackamas, Multnomah, Washington and Marion counties, it also offers six Medicare Advantage plans in the Portland metro area, plus Clatsop, Morrow and Umatilla counties. From its start, FamilyCare has incorporated osteopathic medicine’s whole-body approach to its philosophy of care.

The CCO did not make any dividend or distribution payments through the first nine months of 2016. It received a $4.1 million quality incentive pool payment in the second-quarter of the year.

By the numbers:

- Third quarter 2016 net income: $17,325,347.

- Average monthly medical spending per member: $300.

- Average members: 116,330.

- Days of cash on hand: 155.

Health Share of Oregon CCO

Health Share of Oregon is a nonprofit founded by a consortium of healthcare organizations and service groups in the Portland metro area. It operates in Clackamas, Multnomah and Washington counties.

With just 10 days of cash on hand, Health Share is the CCO least prepared to weather a financial crisis. (Willamette Valley Community Health has the second-smallest cash buffer, with 16 days of cash on hand, with most CCOs reporting enough cash to survive for at least a month on their own.)

The CCO did not make any dividend or distribution payments through the first nine months of 2016. It received a $42.7 million quality incentive pool payment in the second-quarter of the year.

By the numbers:

- Third quarter 2016 net loss: $1,391,145.

- Average monthly medical spending per member: $358.

- Average members: 220,466.

- Days of cash on hand: 10.

Intercommunity Health Network CCO

Intercommunity Health Network CCO is a nonprofit founded in 2012 by a consortium of healthcare groups within the communities it serves in the Willamette Valley and along the mid-Oregon coast. It is administered by Samaritan Health and operates in Benton, Linn and Lincoln counties.

The CCO did not make any dividend or distribution payments through the first nine months of 2016. It received an $11 million quality incentive pool payment in the second-quarter of the year.

By the numbers:

- Third quarter 2016 net income: $1,447,264.

- Average monthly medical spending per member: $370.

- Average members: 54,906.

- Days of cash on hand: 132.

Jackson Care Connect

Jackson Care Connect was created through a partnership with CareOregon and Jefferson Behavioral Health / Jackson Mental Health, plus a broad scope of other healthcare providers. It only serves Jackson County.

The CCO did not make any dividend or distribution payments through the first nine months of 2016. It received a $588,769 million quality incentive pool payment in the second-quarter of the year.

By the numbers:

- Third quarter 2016 net income: $923,000.

- Average monthly medical spending per member: $331.

- Average members: 29,884.

- Days of cash on hand: 30.

PacificSource

Eugene-based nonprofit PacificSource operates two coordinated care organizations, one in central Oregon and one in the Columbia River Gorge area, in addition to a traditional private health plan and Medicare offerings.

Financial statements break out some CCO-specific details, and combined both PacificSource CCOs into a single figure in other cases.

The two CCOs did not make any dividend or distribution payments through the first nine months of 2016. They received $12.7 million quality incentive pool payments in the second-quarter of the year.

Combined, the two CCOs had 58 days of cash on hand.

PacificSource – Central by the numbers:

- Third quarter 2016 net loss: $1,036,124.

- Average monthly medical spending per member: $380.

- Average members: 49,170.

PacificSource-Gorge – by the numbers:

- Third quarter 2016 net income: $583,234.

- Average monthly medical spending per member: $375.

- Average members: 12,124.

PrimaryHealth of Josephine County

PrimaryHealth of Josephine County is a nonprofit founded in 2012 to serve its southern Oregon community as a CCO.

The CCO did not make any dividend or distribution payments through the first nine months of 2016. It received a $1.2 quality incentive pool payment in the second quarter of the year, and a $927,498 quality incentive pool payment in the third quarter.

By the numbers:

- Third quarter 2016 net income: $1,365,384.

- Average monthly medical spending per member: $398.

- Average members: 9,460.

- Days of cash on hand: 52.

Trillium Community Health Plan

Trillium Community Health Plan is a for-profit that was already incorporated as an insurance company before it became a CCO, so it is licensed by both the Oregon Health Authority and the Department of Consumer and Business Services, which houses the state’s Insurance Division. It is owned by St. Louis-based Centene Corp., a Fortune 500 company.

The Trillium CCO did not make any dividend or distribution payments through the first nine months of 2016. It received a $4.3 million quality incentive pool payment in the first quarter of the year, a $4.7 million payment under this program in the second quarter, and a $5.99 million payment in the third quarter.

By the numbers:

- Third quarter 2016 net income: $8,294,286.

- Average monthly medical spending per member: $364.

- Average members: 92,058.

- Days of cash on hand: 60.

Umpqua Health Alliance

Though it does business as the Umpqua Health Alliance, this Douglas County-focused CCO is a for-profit legally incorporated under the name DCIPA LLC. It’s owned by Architrave Health LLC, which in turn is owned by Mercy Medical Center and medical practitioners within the region.

The CCO reported a $10.9 million dividend or distribution to its owners in the third quarter, after making $1.3 million dividend or distribution in the first quarter. It received $2.2 million quality incentive pool

payment in the first quarter of the year, and a $2.6 million payment through the program in the second quarter.

By the numbers:

- Third quarter 2016 net income: $713,388.

- Average monthly medical spending per member: $363.

- Average members: 25,555.

- Days of cash on hand: 92.

Western Oregon Advanced Health

Created in 2012 to serve Coos County and northern Curry County, Western Oregon Advanced Health is run by a consortium of doctors along the Oregon coast.

The CCO did not make any dividend or distribution payments through the first nine months of 2016. It received a $4.4 million quality incentive pool payment in the second-quarter of the year.

By the numbers:

- Third quarter 2016 net income: $423,157.

- Average monthly medical spending per member: $442.

- Average members: 18,521.

- Days of cash on hand: 24.

Willamette Valley Community Health LLC

Willamette Valley Community Health was organized in 2012 to serve Marion and Polk counties.

The CCO did not make any dividend or distribution payments through the first nine months of 2016. It received an $17.4 million quality incentive pool payment in the second quarter of the year, and $100 through this program in the third quarter.

By the numbers:

- Third quarter 2016 net income: $2,375,592.

- Average monthly medical spending per member: $336.

- Average members: 97,754.

- Days of cash on hand: 16.

Yamhill CCO

Created in 2012 to serve Yamhill and parts of Clackamas, Washington, Polk, Marion and Tillamook Counties, Yamhill Community Care Organization is a registered nonprofit.

The CCO did not make any dividend or distribution payments through the first nine months of 2016. It received a $45,579quality incentive pool payment in the second quarter of the year.

By the numbers:

- Third quarter 2016 net income: $131,814.

- Average monthly medical spending per member: $337.

- Average members: 24,482.

- Days of cash on hand: 85.

---- Reach Courtney Sherwood at [email protected]. Follow her on Twitter at @csherwood.

While these numbers are derived from the Oregon Health Authority's financial reports, They do not represent the true financials of the CCO's. You would do better to ask the CCO's for their own financials to get a more accurate picture. The area least reported in the OHA figures are the related entities who conduct the majority of the business for a number of CCO's. They are the ones who hold a majority of the cash and reserves. OHA does not collect information on the related entities, making their financial reporting virtually worthless. Additionally, you mention that FamilyCare paid no "dividends or distributions" in the first nine months. FamilyCare is a not-for-profit corporation with no owners or stockholders. As such we never pay dividends.

Jeff Heatherington