OPINION -- A New York Times report released yesterday put the spotlight on healthcare prices. We all know that healthcare still costs too much, but too often, we have little information about how much it does cost and why. Here at OSPIRG, we are trying to do something about that. But in the meantime, what we do know shows that prices for the same service can vary wildly from one hospital or clinic to the next, even for facilities within a few miles of each other. The new data shows that there are also big variations in price depending on where people get their health coverage.

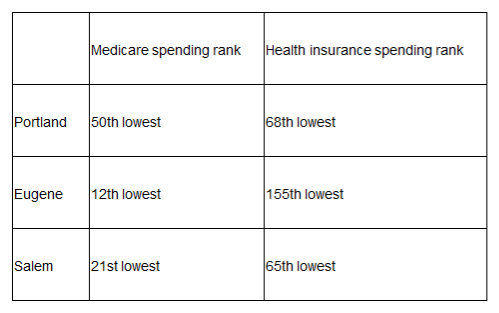

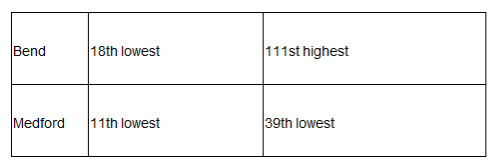

Specifically, the report shows that parts of the country with low Medicare spending do not necessarily have lower healthcare prices for those of us with commercial insurance. In fact, many areas with unusually low Medicare spending have unusually high prices for people who get their insurance elsewhere. Here’s where some of Oregon’s cities rank for spending in Medicare and commercial insurance among the cities considered in the report:

On the bright side, four of these five cities are below the national average in both categories. However, these variations are dramatic, the reasons for them are unclear, and without greater transparency, there is little that consumers can do to protect themselves from high prices.

This data raises some tough questions for policymakers:

- Is Oregon doing enough to address rising healthcare costs for all consumers? The state has relatively low Medicare spending, and has invested in a big overhaul of the Medicaid program to cut costs, but neither of these efforts address costs for commercial health insurance. Further action may be needed to ensure that lower costs benefit all Oregonians.

- Are healthcare providers “cost-shifting?” Economists and health policy experts have long debated whether hospitals and other healthcare providers shift costs to health insurers to make up for lower reimbursement rates from Medicare and Medicaid. While the high prices charged to consumers with commercial insurance in Bend and Eugene—which have some of the lowest Medicare rates in the nation—certainly suggest this may be going on, the evidence for this is mixed.

- Is it all about competition? One key difference between Medicare and commercial insurance is the role of market competition. Research suggests that healthcare prices are generally lower in areas with lots of hospitals and clinics competing for our business—one study found that hospitals with a local monopoly have prices 15.3 percent higher than those in cities with four or more hospitals—but the New York Times report suggests that this may work differently for Medicare than for commercial insurance, since Medicare does not have to negotiate rates with hospitals based on their market power. Out of the cities listed above, Portland has the most competition as well as the smallest disparity between Medicare and commercial insurance costs, but it is unclear from the information available whether those factors are related.

- Why don’t we have answers to these questions? With healthcare costs largely opaque to consumers and policymakers alike—and often a mystery even to hospital administrators and others in the healthcare industry—it is hard to answer these questions, which may be critical to addressing rising healthcare costs going forward. Oregon policymakers should redouble their efforts to make accurate, actionable information about healthcare costs more widely available.

Jesse Ellis O’Brien is the healthcare advocate for OSPIRG and can be reached at [email protected].