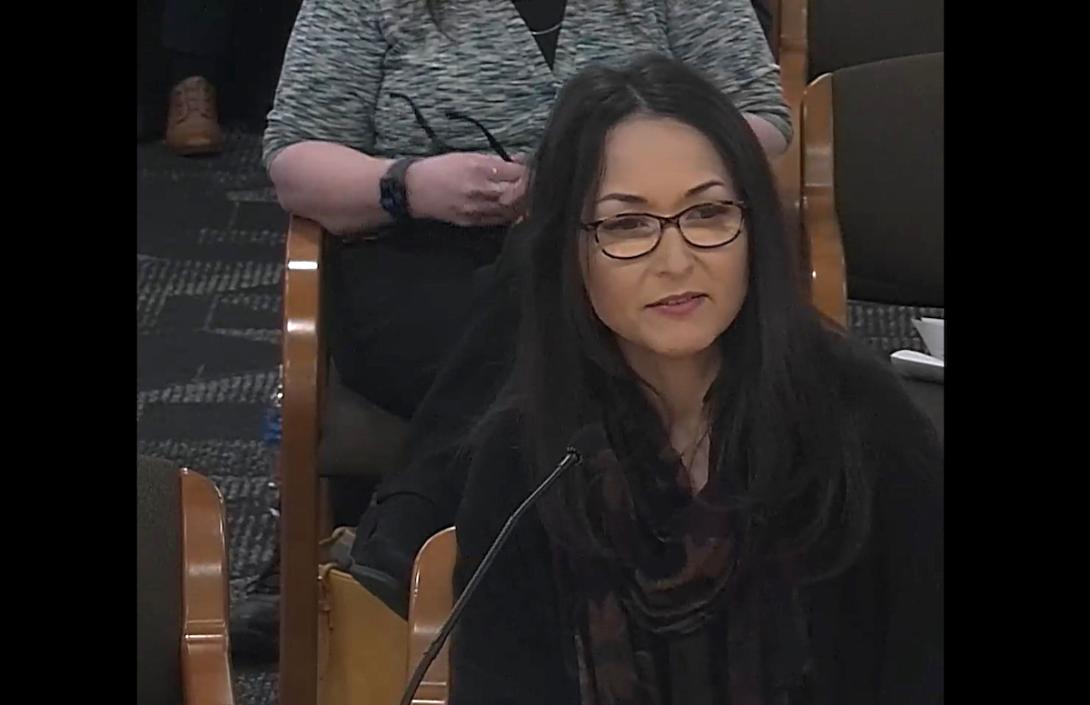

Christine Reeh, a therapist with an independent practice, said a clerical error meant she had to fork over $10,000 to an insurance company on top of paying for an attorney.

Speaking to a legislative panel Tuesday, Reeh described what she called a “long and arduous audit with one of Oregon’s largest health care insurers.” The cause of the audit, she said, was a software glitch that recorded her providing less than 53 minutes of therapy when she had provided 60 minutes.

“The insurance company was not willing to consider the clerical error and not willing to negotiate,” she said.

Reeh said she’s considering dropping the insurance company which would mean ending her work with its members, many of whom are intensive care unit nurses, emergency health care workers and respiratory therapists who’ve faced increasingly stressful working conditions.

Other therapists told similar stories to the Oregon House Behavioral Health and Health Care Committee on Tuesday during a hearing on House Bill 2455. The bill places guardrails on how insurers and coordinated care organizations, regional insurers contracted to oversee Oregon’s version of Medicaid, can audit mental health providers.

It also limits their ability to demand providers pay back reimbursements flagged by audits — and prohibit auditors from receiving incentives based on the amount of overpayments they find.

Insurance fraud and waste are real issues. According to the bill’s summary, audits of Medicare Advantage plans between 2011 and 2013 revealed $12 million in overpayments for 18,000 patients.

But state Rep. Rob Nosse, a Portland Democrat who chairs the committee, said he’s concerned these audits are driving away mental health providers at a time when the state is trying to improve access to them. He said he sponsored the bill as a continuation of his previous legislation aimed at making mental health care as valued as other medical services.

“I think that part of what we’re also hearing is that there’s just a level of scrutiny that is expensive, makes the job, frankly, not as rewarding or challenging, and is taking away from providing patient care when we know we’re in a bit of a behavioral health crisis.”

“We have to have things in place to make sure that people are getting good care and that nobody’s frauded the system, occasionally that does happen," He said. “But I think that part of what we’re also hearing is that there’s just a level of scrutiny that is expensive, makes the job, frankly, not as rewarding or challenging, and is taking away from providing patient care when we know we’re in a bit of a behavioral health crisis.”

Nosse said the bill was carefully crafted to comply with federal auditing requirements. However, questions remain over whether the legislation threads that needle.

“Right now, we’ve got a conflict between the current insurance code and the bill before you,” Richard Blackwell — government relations director for PacificSource Health Plans, a contracted coordinated care organization for several western and central Oregon counties — told the committee.

Specifically, he pointed to how the bill prohibits audits from being based on samples of reimbursement claims submitted by providers, saying that conflicts with federal auditing requirements of Medicaid. He also said that a proposed amendment to the bill could create “less robust” fraud protections for commercial insurance.

Henry O’Keeffe, a lobbyist representing the Coalition for a Healthy Oregon (a coalition of coordinated care organizations), echoed those concerns.

Larry Conner, a Lake Oswego-based counselor, told the committee that he helped write the bill after hearing from other mental health providers about the audit practices of insurers and coordinated care organizations. Audits typically find “simple clerical mistakes” that prove costly for providers, he said.

Conner said that he’s seen “recoupments,” reimbursement money insurers demand providers pay back after audits, that have ranged from $10 to $20,000 for individual providers and up to three-quarters of a million dollars for group practices. Many providers don’t make enough money to cover these costs, he said.

“Out of fear, providers are stopping to work with certain insurances or stopping to accept any insurance,” he said. “And some have closed their practices.”

H.B. 2455 requires insurers and coordinated care organizations to provide more detailed information to mental health providers about audits.

Among its other provisions, coordinated care organizations and insurers would have to notify a provider within 30 days of changes to audit requirements. They’d also have 180 days to complete an audit and allow providers to fix errors. Currently, providers can face audits for claims made seven years ago and 10 if there is suspicion of fraud.