U.S. Sen. Ron Wyden and senior advocates urged families to spend part of their Thanksgiving giving help to older adults facing add-on choices in Medicare.

The Oregon Democrat leads the Senate Finance Committee, which conducted a hearing Oct. 18 into the advertising campaigns, which consist of broadcast commercials, phone calls and email messages in addition to mailings. The multibillion-dollar campaigns are intended to push would-be Medicare recipients to sign up for Medicare Advantage plans offered by private insurance companies. Medicare is the federal program of health insurance for people age 65 and up, and some people with disabilities.

These ad campaigns are in full swing now — Wyden described them as “flagrant consumer abuse of the nation’s elderly” — through the end of the Medicare open-enrollment period Dec. 7.

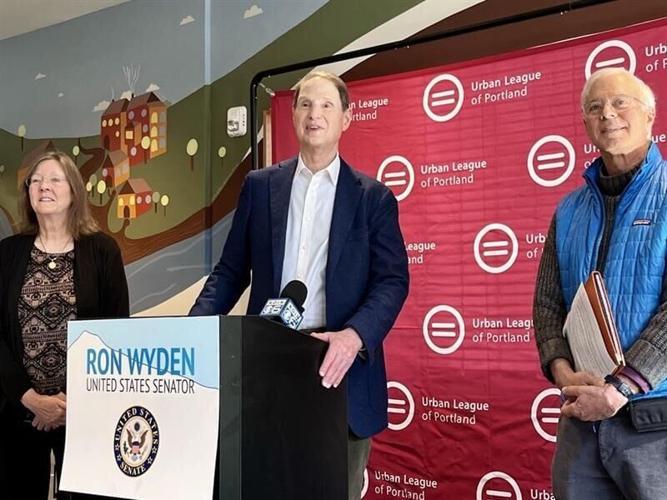

“What we are really talking this Thanksgiving is a sideline plan to stop the scamsters,” Wyden said Monday, Nov. 20, at the event sponsored by the Urban League of Portland at the Hattie Redmond Apartments in North Portland. “It’s time to beat the stuffing out of these scams.”

Before he left for the event, Wyden said, “I saw a commercial where the people said they weren’t as bad as the other commercials. Get your hands around that.”

Congress has already acted to bar insurance companies and go-betweens from masquerading as the official Medicare program – and for them to stop offering nonexistent benefits. But Wyden said the go-betweens still use telemarketing, usually based in “boiler rooms” in states with little or no regulation, to target vulnerable older people.

“There are no limits on how many times these marketing middlemen sell seniors’ personal data,” Wyden said. “Once a middleman gets that information out of one senior, it’s open season. It can be sold again and again.

“Then they bombard them with call after call through the Thanksgiving holiday, trying to sell them health insurance. I am pushing to target the bad actors who are selling this health insurance – the brokers who draw the most complaints and the highest disenrollment rates.”

Wyden, whose committee has authority over major federal health insurance programs, said he wants to see regulation by the Centers for Medicare and Medicaid Services.

“If they do not, I want to pledge to the seniors of Oregon and all their families — who get these commercials every 10 minutes — that I’m going to introduce legislation as chairman of the Senate Finance Committee,” he said. “I think we will get bipartisan support to fix this.”

Since 2011, when the first people in the post-World War II generation known as the baby boomers turned 65, an estimated 10,000 Americans join the Medicare-eligible ranks every day. Oregon now has about 920,000 Medicare recipients. Within three years, that total will approach 1 million in a state with 4.2 million people now.

More advisers needed

Donna Delikat, a Medicare recipient herself, is a field officer and trainer for Senior Health Insurance Benefits Assistance. The state program consists of trained counselors who advise people on Medicare and related issues. She has done this kind of advocacy since 2005, when Medicare Part D — which provides coverage for prescription drugs — took effect.

She offered three points of advice:

• Seek help to understand how insurance plans affect you: “We encourage anybody who is considering a plan to vet that information with a trusted source,” either SHIBA or licensed insurance agents, who “are not part of boiler rooms trying to get another enrollment. They are vested in goodwill and the most appropriate plan for their clients.”

• Do not volunteer personal information such as date of birth, bank accounts, Social Security and Medicare numbers: “That information can be used to harm you.”

She said people can obtain information about plans without having to provide anything more than a mailing address. If someone wants to enroll in a specific plan, however, that personal information can be provided to a SHIBA counselor or insurance agent. Medicare itself will call recipients only when they invite it, such as filing a complaint.

• Check with your doctor and any other medical provider to make sure that your proposed coverage meshes with billing for their services. If providers are not within a plan’s approved network, Medicare recipients may end up paying far more — and out of their own pockets.

“We have seen a lot of change in provider networks this year and there are a lot of changes in plans. Every year, people should review their current plans against any new options that may be available in the coming year. There might be something that fits you better or has benefits you are seeking.”

SHIBA offers information via video on its website (SHIBA.Oregon.gov) plus a publication and a call center for counselor appointments, tailored by geography so that people can visit one of about 150 counselors statewide. But Delikat said that because of the impending enrollment period, many counselors are already booked through Dec. 7 — and some Oregon counties still lack trained counselors. Many of them are peers who, like herself, are Medicare-eligible or recipients.

Choices affect well-being

Larry Jacobson is manager of Eldercare Advocacy Partners LLC and part of Be A Hero, an organization that has raised questions about Medicare Advantage plans and practices.

“It’s a difficult thing for seniors to sort through all these confusing messages they are getting. The advertising is overwhelming,” he said. “Their eyes glaze over, they freeze and they say they will pick the first one that comes along. It’s very challenging.”

He said some do not know the difference between the original federal Medicare program, enacted in 1965, and private Medicare Advantage insurance plans that were introduced under a 1997 law as Medicare Part C.

“Advocacy is about trying to help people get the information they need so they can make informed decisions and not have their arms twisted in ways that are unfair to them and a conflict of interest in many ways.”

Delikat said Medicare recipients should consider their choices for add-ons much like any long-term financial transaction.

“The value of speaking with somebody who navigates through the health-care system and understands the Medicare options cannot be understated,” she said. “I would not think to invest my money in any financial products without consulting a financial expert. I would not want to make a decision on my health-care options without consulting a health-care expert. This not only affects your health, but also your financial well-being.”