Independent providers have long complained that federal policies are unfairly driving up costs —and them out of business — by paying hospital-affiliated clinics significantly more for providing the exact same care.

Well, now there’s evidence that private equity’s acquisition of independents may drive up the cost of care by roughly the same amount as when hospitals take them over.

Those increases in costs get passed on to patients, consumers and the general public.

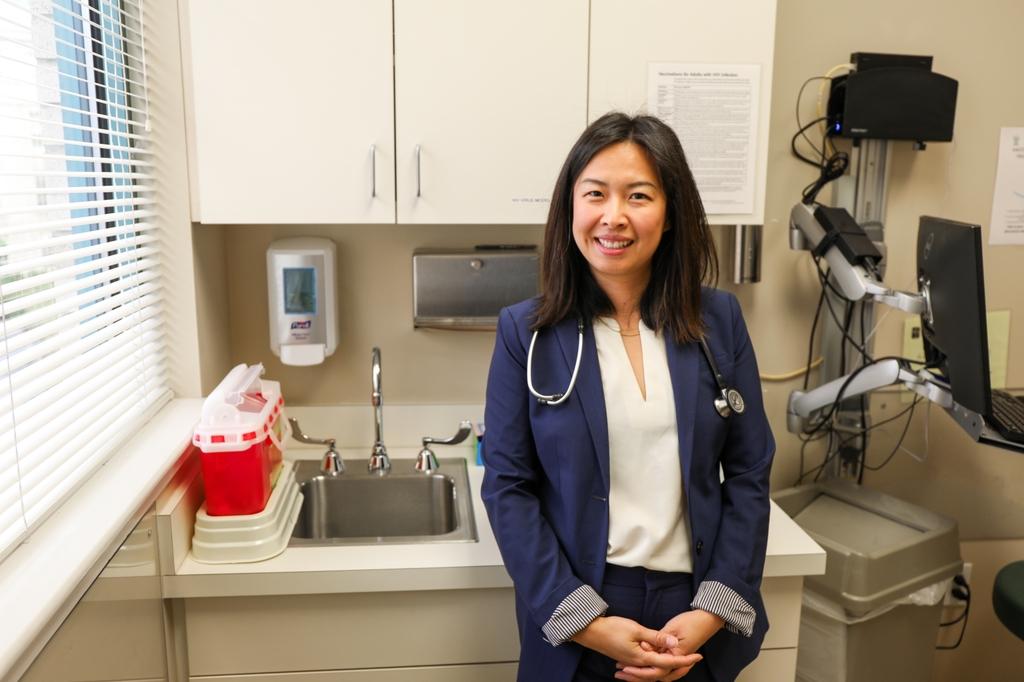

Dr. Jane Zhu, an associate professor of medicine at Oregon Health & Science University, coauthored a new study published by the prestigious health policy journal Health Affairs that put a microscope on what happens to billing when gastroenterology clinics get taken over. Those clinics, which offer screenings, colonoscopies and other types of care for digestive systems, have been a major target for private equity’s expansion into the health care business.

Zhu, with colleagues from Harvard, Brown and Johns Hopkins universities, broke down insurer-reported data in a way that had not been done before and found that billing per claim jumped by 28%. Most of that was an increase in the professional fees going to providers, which jumped 78%.

Exactly how that happened is unclear, though the study notes that private equity owned firms are able to “command higher professional fees” under contracts negotiated with insurers.

Already, billing for colonoscopies in firms operated both by private equity and health systems have drawn scrutiny at times for being excessive and stemming from questionable business practices.

One practice that can boost payments is billing for two colonoscopies instead of one in cases requiring additional time for a more complicated removal of potentially cancerous or pre-cancerous polyps.

The clout of large chains owned by private equity can boost prices negotiated with commercial health insurers.

It’s also possible that gastroenterologists paid by private equity more frequently report finding and removing polyps despite no reported difference in case complexity, according to the study, which cited analyses that “suggest that our results may have been driven by increased use of certain services such as the removal of polyps during colonoscopies.”

Increased reimbursements from private insurers have become all the more alluring because reimbursements paid by government programs such as Medicaid and Medicare have remained flat or are declining, according to Zhu. For independents, lack of reimbursement fuels the pressure to sell or shut down.

After private equity moves in to acquire clinics, she said of the study's findings, “we have increases in volume, we have increases in prices, and a lot of those price increases are going directly to benefit the clinicians working in those practices.”

Zhu added, “There are clear reasons why these medical practices might be interested in private equity, and one of those reasons is that private equity gives some market power and leverage to negotiate higher commercial rates ... And some might argue that that is actually commensurate to what these practices need to survive and to do well in the current market.”

Meanwhile, “Independent practices are becoming fewer and far, far between,” she said.

So as policymakers try to level the playing field between hospital-owned clinics and other ones, they might want to consider other policies to address private equity as well, the paper contends.

Simply addressing facility fees, Zhu said, “may not be enough to reduce costs in the system if private equity is being allowed to negotiate unfettered, higher professional fees without any checks or balances.”