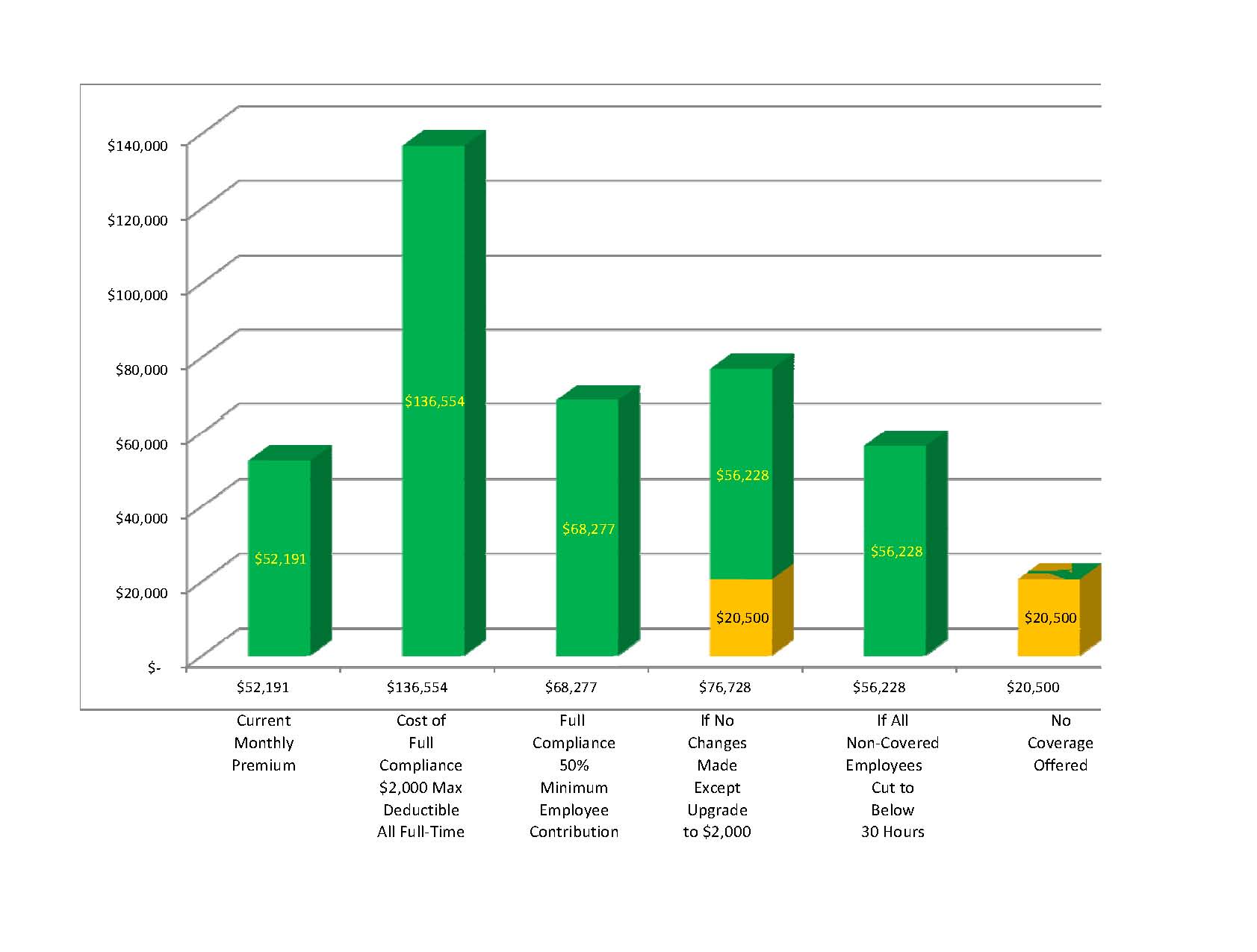

OPINION – March 26, 2013 -- A southern Oregon non-profit organization, currently employing 205 employees, is wrestling with the implications of health reform on its organization. Of the 205 employees, 63 employees are considered administrative staff or professional and they are covered by health insurance with the employee premium fully paid. There are an additional 90 employees who would now meet the new definition of full-time employees at 30 hours per week. These employees are not currently offered health insurance. The non-profit organization now has a total of 153 30-hour full-time employees and 47 part-time employees. Their current monthly insurance premium for the 63 employees on a $3,000 deductible plan is $52,191 for medical and prescription drug coverage.

Like most employers, the organization’s first goal is to take as good care of their employees as best it can afford while still providing, in this case, much needed community services. An employer’s second goal is usually to maintain a competitive advantage to continue to attract qualified employees. When it is time for this non-profit organization to renew their plan in 2014, they face some really tough choices relative to accomplishing their primary goal, choices that directly impact their employees in unintended ways.

To come into compliance with the Affordable Care Act, they will first have to lower their deductible to $2,000. This is the maximum deductible allowed for group insurance under the new law. They will have to purchase one of the newly approved plans that meet government requirements and include all those so-called “free” benefits that have been added. We do not know how much these new plans will cost, but in all probability they will be higher than current prices. We can only use known current prices for purposes of this illustration, so keep this thought in mind when you review the chart and findings here. Actual results could be significantly much worse.

Under the new law, the organization will have to expand the $2,000 deductible coverage to all 153 full-time employees at a cost of $136,554, which is a 162 percent increase in the cost of coverage. This is a burden that the organization would be unable to shoulder without reducing both the number of employees and the amount of care they can provide to the community. One would think that surely there has to be some good alternatives, so let’s explore some of them.

Currently they pay 100 percent of the employee premium; however they are only required to pay half of that. If they only paid half, they could cut their cost to $68,277. What about the employees? A great majority of the employees are single women, many with children, who simply could not afford to pay the other half. This is not a good option for the employees and still considerably increases the organizations’ operating costs.

What if they don’t make any changes to what they are currently doing and cover the same 63 people? They would still be required to offer a more expensive $2,000 deductible plan and would now have to pay a monthly $20,500 to the government. The total cost of this option is $76,228. The penalty calculation is based on the annual penalty of $2,000 applied to 90 currently uninsured employees divided by 12 months.

Another option available to them would be to continue coverage for the 63 employees currently being covered and cut the hours of all other employees to below the 30-hour work week, eliminating the requirement to provide coverage in the first place. This would be a small increase over their current monthly premium of $52,191 to $56,228.The increase reflects the more expensive $2,000 deductible plan. They do not like this option either, because they do care about their employees and feel this would not provide those affected with a living wage if hours are cut to below 30 hours.

Regardless of which option they should choose above, there is another quirk to the new law. If the organization provides coverage to their employees, they have to make dependent coverage available as well although they don’t have to pay for it. The employee, who wants dependent coverage for their children, has to purchase that dependent coverage from the group plan at a cost of over $700. Due to an IRS ruling, employees with group coverage are prevented from purchasing dependent coverage through the exchange and getting a subsidy. These employees would have to purchase group coverage, pay full price for an individual policy or go without insurance for their dependents.

What happens if they simply don’t provide coverage for their employees? They simply pay a monthly fine of $20,500 to the government and the employees go without any coverage. This appears to be the best choice for doing what is right by the employee. All employees, based on the group’s average incomes, can purchase their own insurance through the exchange with a subsidy that covers the employee and dependent children for under $300 and in some cases less than $100. The only disadvantage to this option is that the employee has to fill out an annual 21-page subsidy application that comes with a 61-page instruction book and touted to be “as simple as doing your taxes.”

I do not know which choice the organization will make. Fortunately they have over a year until their 2014 group renewal. If they should decide to cut below 30 hours as a solution, they have to decide much earlier since 2013 hours are used to determine 2014 penalties due.

What would you do?