A new Avalere analysis finds that proposed Medicare payment changes for physician-administered drugs would reduce reimbursement for those that cost more than $480 per day in 2016. As a result, specialties that use higher-cost drugs, including ophthalmologists, oncologists, and rheumatologists, would experience a reduction in payments; though, many of the drugs do not have lower cost alternatives. The analysis shows that seven of the 10 drugs that constitute the largest reduction in reimbursement are used to treat cancer. Meanwhile, some primary care physicians, who tend to use lower cost drugs, would be paid more.

On March 8, the Centers for Medicare and Medicaid Services (CMS) proposed the new rule in an effort to rationalize how Medicare pays for physician-administered drugs (e.g., infused chemotherapy) under Part B. The rule seeks to eliminate financial incentives for providers to prescribe more expensive drugs. If finalized, the first phase of the rule would change Medicare payments for about half of providers from 106 percent of the average sales price (ASP) of the drug to 102.5 percent of the ASP plus a flat fee of $16.80 per drug, per day. Consistent with current law, payments to physicians would be further reduced by two percent as a result of budget sequestration. The payment changes are proposed to begin in the fall of 2016 and would continue for five years while CMS evaluates the impact of the model.

Impact by Product Cost

Initially, the proposed changes would be budget neutral across all Part B drugs, but would result in higher or lower payments for particular products. Specifically, drugs that cost providers more than $480 per day on average would result in lower reimbursement under the new model, whereas products costing less than $480 would receive higher payments than what occurs today. Because Medicare beneficiaries without supplemental insurance coverage are responsible for 20 percent of the payment, beneficiary out-of-pocket costs would increase for lower cost drugs (those below $480).

“We have found that $480 is the tipping point for how Part B drug reimbursement would change under this new rule,” said Adam Borden, vice president at Avalere. “Physicians who prescribe drugs that cost more would receive lower Medicare payments.”

Impact by Provider Specialty

Another effect of these proposed Part B payment changes is a redistribution of Part B spending across provider types. Specialists who use more expensive drugs would experience a decrease in their Medicare reimbursement for these products, while specialists who use lower cost drugs would be paid more than under the current system.

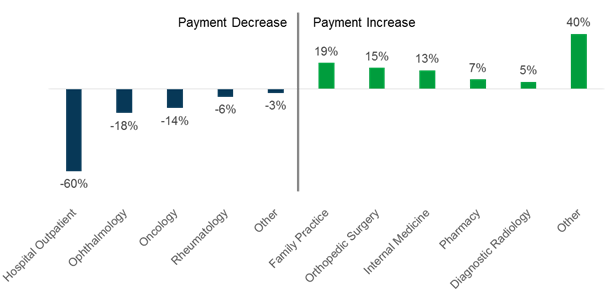

The figure below shows the initial aggregate impact of the Part B drug payment changes by specialist, if the payment changes were implemented in all regions nationwide. Notably, hospital outpatient departments are projected to lose the most revenue as a result of the changes—accounting for 60 percent of all payment reductions under the new model. Ophthalmologists are the most impacted specialty group—accounting for 18 percent of all the payment reductions. Cancer doctors and rheumatologists would also receive lower Medicare reimbursement as a result of the rule. By contrast, primary care providers (family medicine and internal medicine physicians) and orthopedic surgeons all stand to benefit due to higher Part B reimbursement for drugs.

Share of Increase / Reduction in Payment Under Proposed Part B Rule, by Provider Specialty

“The proposed Part B payment changes would redistribute funding from some specialists who use newer, more expensive drugs to care for their patients,” said Fauzea Hussain, senior vice president at Avalere. “In many cases, there are no lower-cost, clinically meaningful alternatives available for these conditions.”

Most Impacted Drugs by Therapeutic Area

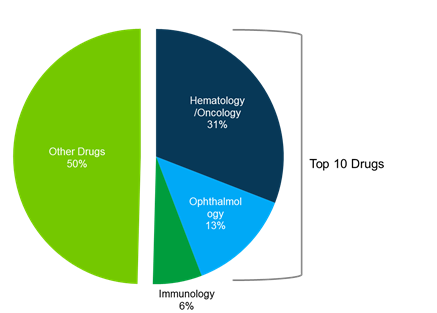

The initial payment reductions are heavily concentrated on a subset of Part B Drugs. As shown in the following graph, more than 50 percent of the payment reductions come from 10 drugs, which experience a cumulative reduction in Medicare reimbursement of $252M in the first year if the changes were implemented nationwide. Seven of these ten products are used to treat cancer, two treat ophthalmic conditions, and one treats immunologic conditions. In 2014, more than 1 million Medicare beneficiaries were treated with one of these 10 drugs.

Total Medicare Part B Payment Reduction Under Proposed Rule Including Sequester Impact for Top 10 Drugs

CMS plans to evaluate the impact of these payment changes on prescribing behavior. Such changes may result in changes in what drugs are prescribed, access challenges for some patients, and shifts in where patients receive care. Phase II of the proposed demo would expand these initial payment changes to test a range of other proposals aimed at reducing Medicare costs.

Methodology

Avalere used the calendar year 2014 Medicare Standard Analytic Files (SAF) 5 percent sample. We included claims for eligible Part B drugs as outlined in CMS’ proposed rule, excluding claims for infused DME drugs and exempt providers. Avalere did not assume changes in drug utilization or prescribing patterns as a result of the payment changes. We assessed impact across all geographies and did not replicate Medicare’s stratified, randomized assignment of providers across primary care service areas. Findings include the impact of sequestration, both on current Medicare payments (ASP+6%) and on payments that would occur under the proposed rule (ASP+2.5% plus $16.80).

###

To speak with an expert from Avalere about this new analysis, please contact Frank Walsh at [email protected], or 504-309-5164.

Avalere Health is a strategic advisory company whose core purpose is to create innovative solutions to complex healthcare problems. Based in Washington, D.C., the firm delivers actionable insights, business intelligence tools and custom analytics for leaders in healthcare business and policy. Avalere's experts span 230 staff drawn from Fortune 500 healthcare companies, the federal government (e.g., CMS, OMB, CBO and the Congress), top consultancies and nonprofits. The firm offers deep substance on the full range of healthcare business issues affecting the Fortune 500 healthcare companies. Avalere’s focus on strategy is supported by a rigorous, in-house analytic research group that uses public and private data to generate quantitative insight. Through events, publications and interactive programs, Avalere insights are accessible to a broad range of customers. For more information, visit avalere.com, or follow us on Twitter @avalerehealth.