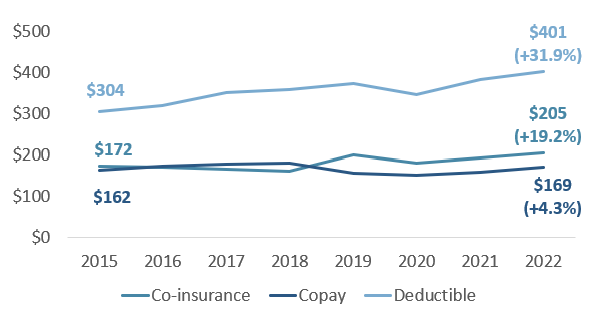

Oregonians with health insurance paid an average of 31.9% more in health insurance deductibles between 2015 and 2022, according to a newly released report delving into rising health care costs.

The latest in a series of analyses issued by the Oregon Health Authority, the April 23 study found that commercial health insurance consumers paid higher costs for services. Insurance premiums for Oregonians rose by about 20% for both family and single plans during the same seven-year period.

The state findings tracked only the raw change in health care costs and did not adjust for inflation — which rose by about 27% during these years, according to federal data.

The report indicates that as health care costs and premiums go up, individuals and companies are increasingly turning to higher deductible plans that place individuals at greater risk if they get sick. The report quotes a public comment received from an unidentified Oregonian during a public hearing of the state’s cost-growth oversight program.

“I currently have a high-deductible health plan that covers nothing until my $8,000 deductible is met each year. I pay nearly $500/month for what really is catastrophic coverage. I use my Health Savings Account to pay out of pocket for all of my health care expenses… Given I pay for all health care out of pocket, I try to inquire about and negotiate rates with providers - a nearly impossible task. As a consumer, I have no idea what something will cost before having to ‘buy’ it. If providers do offer a ‘cash rate’ it would often cost less than going through my insurance company, which also means those payments don't count towards my deductible each year.”

Since 2013, Oregon health care expenditures grew more than 40% to nearly $8,000 a person, according to the report. One state study found that more than a third of Oregon adults report that they’re struggling to pay their medical bills.

Job-based coverage drives trends

About half of Oregon households carry commercial insurance, and most of them (92.7%) get their insurance through an employer. Only 7.3% are insured on the individual market, the study found. From 2015 to 2022, the proportion of employer-sponsored plans defined as high-deductible plans grew from about a third to more than a half.

Other findings included:

- Average deductible amounts for Oregonians’ family plans through commercial insurers grew 62.2%, from $2,462 to $3,994. Single plans increased by 41%, from $1,496 to $2,110.

- Average increases in commercial co-insurance) and copays weren’t as steep as the climb in deductible costs betweeen 2015 and 2022. Patients’ portion of cost sharing grew by a total of 17.4% from 2015 to 2022, while the cumulative growth in the amount paid by insurers was 42.3%.

Overall, patients paid 16% of the total cost of care in 2015, compared to 13.6% in 2022.

With Medicare Advantage, the privatized version of Medicare that has become increasingly controversial in recent years, the story is a bit different.

Compared to the commercial market, seniors covered by Medicare Advantage saw their costs for care go up far more rapidly in Oregon than what insurers paid between 2015 and 2022.

Amounts paid in cost sharing increased 17.7% for Medicare Advantage members in Oregon while the costs of care shouldered by insurers grew only 8.6%.

Officials cite ripple effects

“Cost sharing is a portion of the health care unaffordability puzzle,” said Sarah Bartelmann, cost growth target program manager for the Oregon Health Authority, during a recent webinar.

Bartelmann added that higher co-pays, deductibles and co-insurance have been shown to have a ripple effect across the health care industry that’s negatively affecting patient outcomes and potentially sending more people to emergency rooms for higher cost services.

“Folks on the individual market are more likely to be delaying care because of cost than folks with group coverage,” she said. “Two in five people in Oregon were estimated to be underinsured so in addition to the delay in care, because of costs and those other things we see these are folks having to skip or delay care (or) space out a prescription longer because they can't afford the co-payments.”

In a statement, OHA Director Dr. Sejal Hathi said the findings of the new report are important.

“Even moderate increases in cost sharing can thwart access for those who need it most. OHA will continue to work both to rein in health care costs and to protect and expand access to care,” Hathi said.

When it comes to employer-based health plans, you need to break it down by the # of lives they insure. For instance, a small employer has zero ability to know what a healthplan actually spent on coverage for their employees in the previous year. The health plan does not have to disclose this information for employers covering less than 100 lives. Instead, they increase rates in double digits each year. It is increasingly difficult for small employers to provide quality health insurance in the current market. The numbers reflected early in this article are misleading when it says rates have increased 20% over the timeframe. Extract the 100+ employee groups and look at the numbers again.

Additionally, payers continue to force rates up - as well as deductibles. How much do they actually end up paying out? How can we get this information? It is unfair to go only by what is billed when so much of it is pushed under deductible, coming out of the pocket of the patient, NOT the payer.