Determining the cost or co-payment of a specialty drug—high-cost drugs typically used to treat complex diseases like cancer or rheumatoid arthritis—has always been complicated. An analysis by Avalere finds that new benefit designs and a lack of clear information from HealthCare.gov is making the situation more complex for consumers as they determine their out-of-pocket costs in exchange plans.

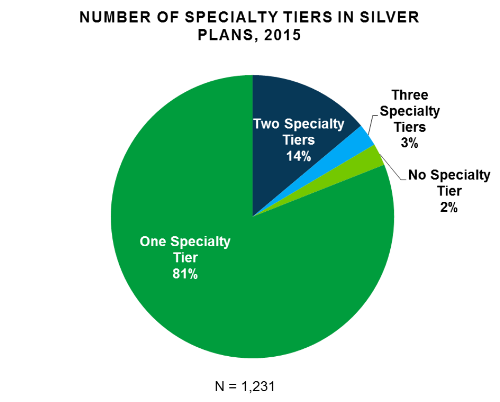

Among Silver plans sold on exchanges, 17 percent use multiple specialty tiers in their 2015 formularies. Those plans typically designate generic, preferred, or non-preferred specialty tiers. HealthCare.gov enrollees have the choice of Bronze, Silver, Gold or Platinum plans, which differ in the percentage the plan pays of overall healthcare costs. Silver plans are the top choice for many Americans. For consumers, placement of a medication on a specialty tier typically translates to higher out-of-pocket costs.

“Consumers purchasing these plans need to understand what’s in their benefit plan and be ready for substantial out-of-pocket costs if specialty products are needed,” said Dan Mendelson, CEO of Avalere. “While these plans are typical of the exchanges and Medicare Part D where insurers are competing to keep premiums low, they remain rare in the employer market.”

Avalere conducted a manual search of plan documents for Silver plans because of inaccuracies noted on HealthCare.gov and in associated data sets. Notably, HealthCare.gov reports formulary cost sharing for all plans in a four-tier structure (including only one specialty tier); however, about 35 percent of Silver plans do not use four-tier formularies. Because of this discrepancy, consumer costs appearing on HealthCare.gov may misstate actual enrollee financial responsibility.

“The mismatch between a plan’s formulary design and the cost-sharing displayed on HealthCare.gov and on state exchange websites may be a source of confusion for consumers,” said Caroline Pearson, vice president at Avalere.

Methods

Analysis using Avalere PlanScape®, a proprietary analysis of exchange plan features, updated December 2014. Data include the federally-facilitated marketplace (FFM) landscape file, as well as plan documents for all silver plans. Avalere did not include health plans in which there was no cost sharing across service categories or that had deductibles that were equal to the out-of-pocket maximum. Avalere made revisions to the FFM landscape file to ensure that only unique plan designs were included in the analysis and a consistent set of states across years. Silver plan selection data applies only to FFM states through December 15, 2014, based on data from ASPE’s December 30 report.

###

If you would like to speak with an Avalere expert about the findings of the analysis, please contact Frank Walsh at [email protected]; 504-309-5164.