A new Avalere analysis finds that of the 17 million Medicare Advantage (MA) enrollees in 2016, 72 percent are in a plan with four or more stars. This represents an increase from 65 percent in 2015 and 51 percent in 2014. The MA Star Ratings program grades plans based on a series of quality measures designed to assess plan performance; the more stars a plan has, the higher quality it is deemed to be.

“The Medicare Advantage market remains competitive,” said Tom Kornfield, vice president at Avalere. “In particular, these results show that not only are plans improving, but beneficiaries are taking notice of quality ratings and using them to make election decisions.”

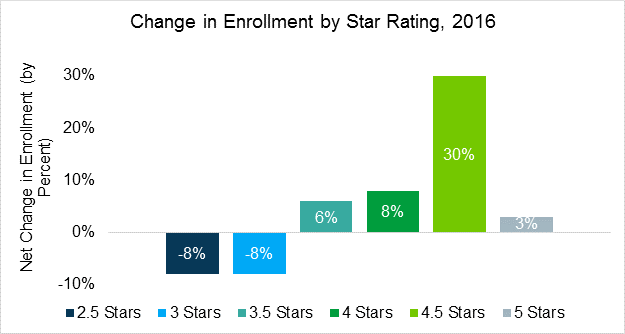

The experts at Avalere say that the increase in enrollment in high-star plans is a result of two factors: plans improving their star ratings performance and individuals choosing higher rated plans. Of note, Avalere found that the number of individuals picking 4.5 star plans increased by 30 percent during the 2016 MA open enrollment period. Meanwhile, enrollment in low-performing 2.5 and 3 star plans decreased by 8 percent.

Avalere notes that the impact of star ratings is broader than the consumer aspect. Performance on star ratings also affects how plans are paid and the benefits offered to enrollees. Specifically, plans receiving 4, 4.5, or 5 stars receive bonus payments and rebates that are used to provide extra benefits to beneficiaries such as dental or vision care.

“Medicare beneficiaries continue to choose from a diverse range of high-quality plans,” said Elizabeth Carpenter, senior vice president at Avalere. “New players continue to enter the market, including plans sponsored by providers.”

While 38 percent of total MA enrollees are in plans with at least 4.5 stars, two-thirds of provider-sponsored MA plan enrollees are members of a plan with at least 4.5 stars. Previous Avalere analysis found that 11 of 19 new entrants to the MA market in 2016 were provider sponsored. Approximately 3.2 million Medicare beneficiaries are enrolled in provider-sponsored plans in 2016.

Additional Avalere analysis on the 2016 Medicare Advantage landscape is available here.

Methodology

The analysis does not include Medicare-Medicaid dual-eligible demonstration plans, Cost, PACE, or plans without star ratings. To assess the volume of individuals actively choosing a higher star plan, Avalere controlled for plan improvement in star ratings between 2015 and 2016. This analysis only includes only plans with star ratings in both 2015 and 2016.

###

To speak with an expert from Avalere about this new analysis, please contact Frank Walsh at [email protected], or 504-309-5164.

Avalere Health is a strategic advisory company whose core purpose is to create innovative solutions to complex healthcare problems. Based in Washington, D.C., the firm delivers actionable insights, business intelligence tools and custom analytics for leaders in healthcare business and policy. Avalere's experts span 230 staff drawn from Fortune 500 healthcare companies, the federal government (e.g., CMS, OMB, CBO and the Congress), top consultancies and nonprofits. The firm offers deep substance on the full range of healthcare business issues affecting the Fortune 500 healthcare companies. Avalere’s focus on strategy is supported by a rigorous, in-house analytic research group that uses public and private data to generate quantitative insight. Through events, publications and interactive programs, Avalere insights are accessible to a broad range of customers. For more information, visit avalere.com, or follow us on Twitter @avalerehealth.