Hospital Uncompensated Care – Uncompensated care is the unreimbursed cost of the care provided by hospitals to people who are uninsured or underinsured. Hospitals provided over $50 billion in uncompensated care in 2013. By greatly reducing the numbers of Americans who are uninsured through the establishment of the Health Insurance Marketplace and by facilitating States’ expansions of Medicaid, the Affordable Care Act has reduced hospitals’ uncompensated care costs.

Medicaid Expansion –Analysis of hospital financial reporting and member surveys from hospital associations indicates that, through 2014, payor mix is shifting in ways that will likely reduce hospital uncompensated care costs. Moreover, a projection model developed by ASPE suggests that the large observed declines in the uninsured and increases in Medicaid coverage have led to substantial declines in hospital uncompensated care in 2014. Medicaid expansion states account for $5 billion of the estimated $7.4 billion reduction in uncompensated care costs attributed to ACA coverage expansions.

Analysis of Hospital Financial Reports

Hospital financial reporting suggests that payor mix shifted significantly during 2014 in ways that will likely reduce hospital uncompensated care costs. In particular:

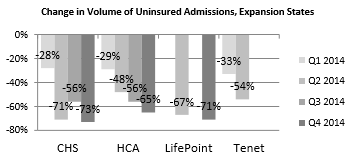

- Volumes of uninsured/self-pay admissions (which comprise a major portion of uncompensated care provided by hospitals) have fallen substantially in states that have elected to expand the Medicaid program through the Affordable Care Act; these volumes have fallen slightly in non-expansion states.

CHS = Community Health Systems; HCA = Hospital Corporation of America; CHS, HCA, LifePoint, and Tenet are hospital systems. Source: Quarterly earnings call transcripts; some data are missing for each system because not all systems report these data each quarter.

- Proportions and volumes of uninsured/self-pay emergency department visits have also fallen substantially, primarily in Medicaid expansion states.

Analysis of Hospital Cost Reports

Our projection model suggests that uncompensated care costs will continue to fall substantially following major insurance coverage expansions, including coverage expansions through both Medicaid and the Health Insurance Marketplace. Specifically:

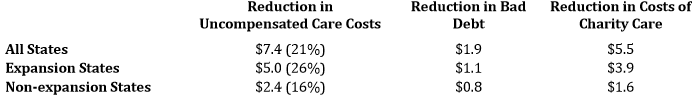

- Based on estimated coverage gains in 2014, ASPE estimates that hospital uncompensated care costs were $7.4 billion lower in 2014 than they would have been had coverage remained at its 2013 level, at $27.3 billion versus $34.7 billion (Table 1). This represents a 21 percent reduction in uncompensated care spending.

- $5.0 billion of this reduction comes from the 28 Medicaid expansion states plus Washington DC, representing a 26% reduction in uncompensated care spending and 68% of total savings. $2.4 billion comes from the 22 Medicaid non-expansion states, representing a 16% reduction in uncompensated care spending and 32% of total savings.

- If non-expansion states had proportionately as large increases in Medicaid coverage as did expansion states, their uncompensated care costs would have declined by an additional $1.4 billion.

Table 1: Estimated Reduction in Hospital Uncompensated Care Costs in 2014 as a Result of Marketplace Coverage and Medicaid Expansion (Billions of $)

Source: ASPE projections from CMS Hospital Cost Report Data and Census Data from 2011 and 2012 as well as 2014 uninsured estimates from Gallup-Healthways and Medicaid enrollment from CMS. Expansion states are defined to include AR, AZ, CA, CO, CT, DE, DC, HI, IN, IL, IA, KY, MD, MA, MI, MN, NH,NV, NJ, NM, NY, ND, PA, OH, OR, RI, VT, WA, and WV. Non-expansion states are defined as all other states.

See http://aspe.hhs.gov/health/reports/2014/UncompensatedCare/ib_UncompensatedCare.pdf for a detailed description of the methods used in an earlier version of this analysis.