A new analysis by Avalere finds that causes of health insurance premium increases in 2016 generally mirror the distribution of healthcare spending in the individual and small group market. Specifically, inpatient and outpatient hospital services are modestly driving premium increases, while physician and other professionals make up less than their expected portion of premium growth. Prescription drugs’ contribution to 2016 premium increases is roughly in line with their costs in 2014. Overall, premiums for 2016 will rise an average of $25.26 per month, with $5.44 of that increase caused by outpatient hospital services.

“Plans always focus on all of their input costs, and hospital and physician spending are the largest categories,” said Caroline Pearson, senior vice president at Avalere. “The data on premium increases for 2016 do not indicate that prescription drugs are having an outsized impact on premiums.”

In this analysis, Avalere examined the medical portion of premium increases—excluding administration, taxes and fees, risk, and profits. We compared the portion of premium increase justifications for each benefit category in 2016 to actual spending reported in the same markets for 2014, the most recent year with complete spending data.

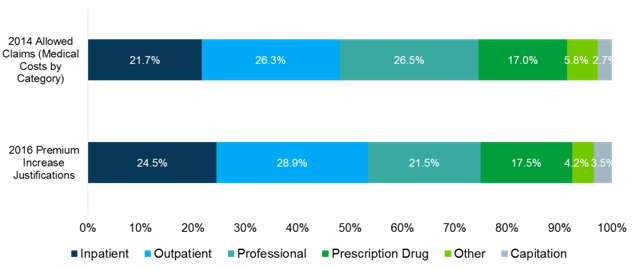

2016 Rate Justification Compared to 2014 Allowed Claims, by Benefit Category, Individual and Small Group Market

Premium growth is primarily driven by inpatient and outpatient hospital spending, which slightly outpace their share of overall costs. For example, hospital services account for 53.4 percent of premium growth, compared to 48.0 percent of actual spending. By contrast, professional services (e.g., doctor’s visits) drove a smaller portion of premium increases, relative to their share of healthcare spending. In 2016, professional services accounted for 21.5 percent of rate increases, compared to 26.5 percent of actual spending in 2014. The portion of rate increases attributed to prescription drugs was roughly in line with drugs as a share of total spending (17.0 vs. 17.5 percent, respectively).

Beginning in 2014, the Affordable Care Act (ACA) establishes a federal rate review process. As part of this process, all plans sold in the individual and small group market—excluding grandfathered plans—are required to submit actuarially-certified justifications of their premium increases, including the portion of the premium increase attributable to each unique benefit category (e.g., inpatient hospital, outpatient hospital, prescription drugs, etc.).

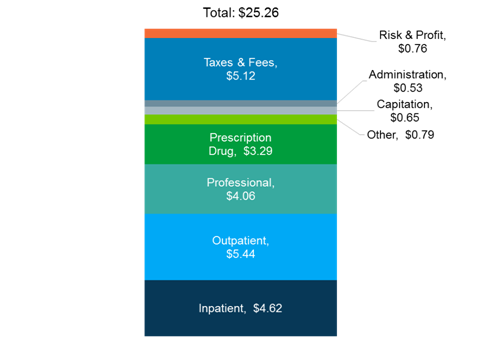

On average, across the individual and small group markets, premiums increased $25.26 per month from 2015 to 2016. Outpatient hospital services account for the largest portion of the increase at $5.44.

Average Dollar Increase in Per Member Per Month Premiums, by Benefit Category, 2016 Individual and Small Group Plans

Methodology

Data in this analysis are based on annual issuer filings of the Unified Rate Review Template (URRT) with the Department of Health and Human Services (HHS). The URRT reports the average per-member per-month (PMPM) premiums for the upcoming plan year in each health plan. Issuers that submit the URRT to HHS are required to submit a corresponding actuarial certification. 2016 premium justification includes all individual and small group market plans who requested a premium increase for the 2016 plan year. 2014 allowed claims is based on the reported allowed claims for all 2014 plans in the individual and small group market who submitted the URRT template for 2016. Prescription drugs include drugs dispensed by a pharmacy; earned premiums are net of rebates received from drug manufacturers. Capitation includes all services provided under one or more capitated arrangements. Other includes non-capitated ambulance, home health care, DME, prosthetics, supplies, vision exams, dental services, and other services.

Importantly, due to limitations in the member months information provided by health plans for the 2014 plan year, Avalere did not weight the analysis by health plan enrollment. In particular, plans in the small group market in 2014 were required to conform to the new Affordable Care Act (ACA) market reforms at the end of their plan year. Many small group market plans had plan years that ended at various points in 2014, therefore causing the member months reporting for the 2014 ACA compliant small group market plans to be artificially low as some members were only enrolled for part of the year.

Avalere Health is a strategic advisory company whose core purpose is to create innovative solutions to complex healthcare problems. Based in Washington, D.C., the firm delivers actionable insights, business intelligence tools and custom analytics for leaders in healthcare business and policy. Avalere's experts span 230 staff drawn from Fortune 500 healthcare companies, the federal government (e.g., CMS, OMB, CBO and the Congress), top consultancies and nonprofits. The firm offers deep substance on the full range of healthcare business issues affecting the Fortune 500 healthcare companies. Avalere’s focus on strategy is supported by a rigorous, in-house analytic research group that uses public and private data to generate quantitative insight. Through events, publications and interactive programs, Avalere insights are accessible to a broad range of customers. For more information, visit avalere.com, or follow us on Twitter @avalerehealth.