Potential federal cuts are raising major questions about state officials’ ability to pay for the health care of 1.4 million low-income Oregonians, even as a key part of the state’s funding plan cleared its first legislative hurdle in Salem.

Passing House Bill 2010 sits at the top of lawmakers’ to-do list. The bill would renew and expand a tax on hospitals and other health care providers. The state uses it to draw down federal matching funds to help pay for free care provided under the Oregon Health Plan, the state’s version of Medicaid.

But President Donald Trump and the GOP-controlled Congress are discussing major cuts to Medicaid — including a slash to the provider tax.

The federal push is creating huge uncertainties around Oregon’s budget situation. And cuts to Medicaid funding would hit Oregon harder than most states.

Not only does the state have one of the larger Medicaid enrollment rates in the country, but the state budget in Oregon is more reliant than most on outside funds when it comes to providing care for low-income people.

People of color make up a disproportionate number of Oregon Health Plan members. The cuts also would hurt providers and health systems that rely on Medicaid revenue to stay afloat and provide care.

“I also know the ramifications if this does not pass. Because I have providers in my district that probably can’t survive. And it’s not just my district, it’s across the state.”

The Hospital Association of Oregon is supporting the provider tax as it pushes for state funding for maternity care to counter worsening access in rural and minority communities.

“This is really about one in three Oregonians that depend on this revenue source for coverage,” Sean Kolmer, the association’s executive vice president for external affairs, told a legislative panel recently. “These are seniors. These are kids. These are rural communities. These are providers. This is about our health care system.”

Provider tax plays major health care funding role

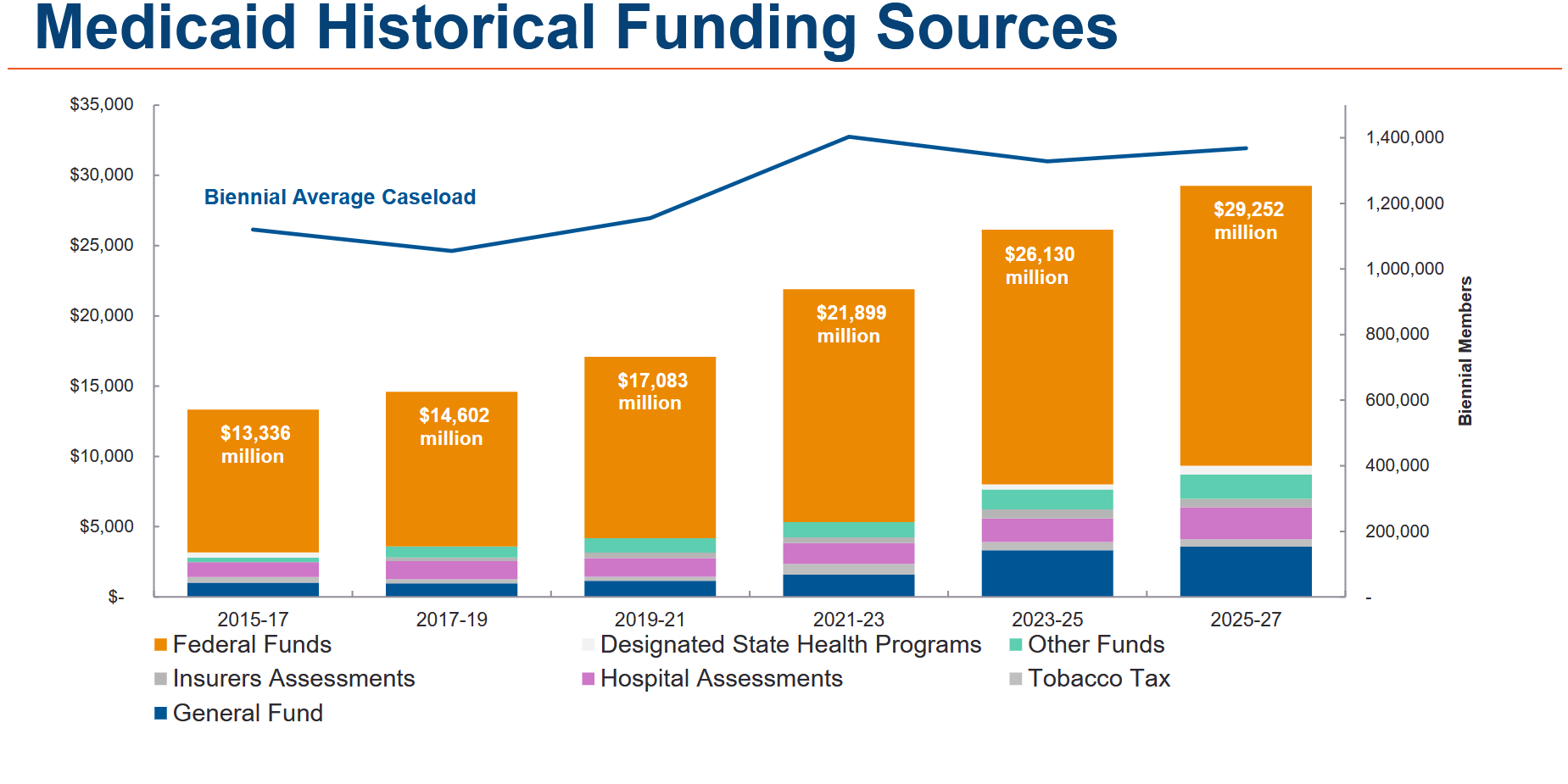

Gov. Tina Kotek’s proposed two-year budget calls for $29.2 billion to fund the Oregon Health Plan, of which 26% is provided by the hospital portion of the provider tax along with its federal match. Overall, federal matching funds make up more than two-thirds of the funding.

Unlike many taxes, Oregon’s provider tax is one that those paying it — hospitals and insurers — don’t mind. That’s because Oregon, like most states, uses the additional federal funds from the tax to pay higher reimbursement rates — meaning those paying the tax get their money back.

“There is a good deal of uncertainty about what is going on at the federal level."

Democratic and Republican administrations have tried to cut the provider tax in the past, only to have those efforts stall in the face of opposition, including from Republican-majority states. This year, majority Republicans in Washington D.C. are focused on cutting Medicaid to help extend corporate and income tax cuts.

The provider tax is not the only cut that’s been floated for the health care program. Federal officials are considering other proposals as well, ranging from work requirements to cutting the federal contribution for low-income care.

State lawmakers support tax amid concern

Members of the Oregon Behavioral Health and Health Care Committee discussed the question marks around Oregon Health Plan funding on Tuesday as they voted overwhelmingly to advance the provider tax bill.

State Rep. Rob Nosse, a Portland Democrat who chairs the committee, said lawmakers will “have very difficult and very painful decisions to make” if Trump and Congress follow through on cuts.

Nosse said that members of Congress may ultimately balk at the reductions to Medicaid once they realize the “ pretty dire consequences.” He added, “We’ll have to wait and see.”

State Rep. Ed Diehl, R-Scio, called the provider tax a “shell game,” alluding to how it is used to secure federal funding that ends up going back to providers. He said he expects it to be ended or “radically altered” in coming years.

“I also know the ramifications if this does not pass,” said Diehl, who voted for the bill. “Because I have providers in my district that probably can’t survive. And it’s not just my district, it’s across the state.”

During a hearing on the bill earlier this month, Diehl asked Emma Sandoe, who oversees Oregon’s Medicaid program, if she was concerned about the federal government changing requirements for provider tax.

“There is a good deal of uncertainty about what is going on at the federal level,” she responded. “We remain vigilant to reviewing all the various work that is happening at the federal level.”

Tax has long history

Oregon has used a provider tax since 2003, expanding and renewing it several times.

With the exception of Alaska, every state and the District of Columbia uses a similar tax to help fund their Medicaid programs.

House Bill 2010 would extend the tax through 2032.

“This is really about one in three Oregonians that depend on this revenue source for coverage. These are seniors. These are kids. These are rural communities. These are providers. This is about our health care system.”

Federal rules cap revenue from the tax at 6% of provider revenue. But Oregon Health Authority officials expect to generate $400 million more from the tax by using a formula used in North Carolina, where Sandoe previously worked.

State provider taxes need to be approved by federal Medicaid officials. State lawmakers are rushing the bill with the hope the tax kicks in by July.

Oregon Health Authority Deputy Director David Baden told The Lund Report that the state’s new method to boost revenue is not new to the federal government — it’s been approved since 2008.

Typically the state provider taxes are approved in the federal government’s “normal course of business,” Baden said. Like other states, he said Oregon will be watching “very closely” to see what, if any changes take place.

Congress mulls provider tax, other cuts

This week, Congress’ budget-writing committees are considering cuts, including to the provider tax.

In January one Congressional committee staff described potential changes to Medicaid that cut the 6% provider tax cap by a third in 2026. The tax would be capped at 3% in 2028.

How much Congress cuts Medicaid funding remains an open question, and could be divisive as Republican Congressional lawmakers try to keep their slim House majority.

But even if Congress does not go after the provider tax, the Trump administration could. In 2020, Trump’s top official overseeing Medicaid, Seema Verma, proposed an administrative rule to cut the tax. Federal administrators under former President Joe Biden made their own effort.

Oregon is more reliant on the provider tax than most other states because it spends far less of its general fund — primarily state corporate and income taxes — on its Medicaid program than others do.

Nationally, general fund contributions made up 23% of states’ Medicaid spending in 2023, according to the National Association of State Budget Officers. In contrast, Oregon’s general fund contribution was less than half that figure.

Why not make something else dependent on the provider tax that is more optional? Why not have an efficiently effort asap to help reduce spending in all domains of the State government? Running something lean and mean is not partisan, its smart.