According to a new Avalere analysis of data from the Centers for Medicare & Medicaid Services (CMS), premiums for standalone prescription drug plans (PDPs) will increase and the number of PDPs available in 2016 will decrease. Conversely, Medicare Advantage (MA) premiums will decrease in 2016, and the number of MA plans on the market will increase, despite years of Affordable Care Act payment reductions.

Key takeaways

Part D:

· Top 10 most popular Part D plans, representing more than 80 percent of PDP enrollment, will have an average premium increase of 8 percent in 2016.

· Average PDP premium in 2016 will be more than $40 for the first time in the program’s history.

· 886 PDPs will be offered in 2016, a decrease from 1,001 in 2015.

Medicare Advantage:

· 81 percent of MA beneficiaries will have a $0 premium option, compared to 78 percent in 2015.

· The average MA premium will drop 1 percent in 2016, to $32.60.

Average monthly premiums for standalone PDPs projected to increase, while the number of PDP options will decline

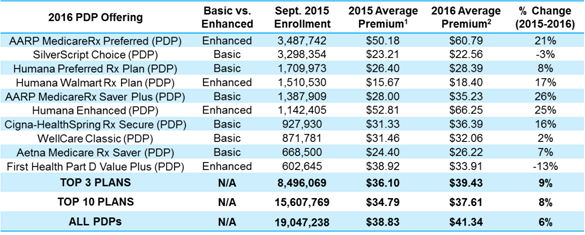

Many beneficiaries are likely to see their Part D premiums increase significantly, with enrollment-weighted premiums projected to increase by an average of 8 percent among the top 10 PDPs that account for more than 80 percent of PDP enrollment. Indeed, within the top 10 plans, five will have double digit premium increases in 2016, as shown in Figure 1. Overall, assuming Part D enrollees elect to remain in their current plan, the average monthly premium for all PDPs will increase by as much as 6 percent, from $38.83 projected in 2015 to $41.34 projected in 2016.

Since 2010, the final average Part D premium has remained remarkably consistent, with limited fluctuations from year to year. The projected premium increase would return premium growth to levels not seen since before the “patent cliff” began in 2011, when several high-cost drugs lost their patents. The 2016 Part D premiums also mark the first time average premiums exceed $40.

Figure 1: 2016 Premium Increases by PDP

The number of PDPs available in 2016 will shrink for the second straight year. In 2016, 886 PDPs will be offered in the U.S., an 11.5 percent drop from 2015. Despite these decreases, beneficiaries in most states will still have 25 or more PDPs to choose from in 2016. Of particular concern to policymakers, the number of $0 premium plans available to poor beneficiaries that receive the low-income subsidy (LIS) will decline. Specifically, the number of LIS $0 premium plans has declined by 32 percent since 2013.

“Medicare beneficiaries should carefully review their prescription drug plan options in 2016 to make sure they choose a plan that is right for them,” said Colin Shannon, senior manager at Avalere Health. “With many plans taking large premium increases in 2016, those beneficiaries that choose not to change plans will likely pay more in premiums than if they look for lower cost options.”

Availability of $0 premium MA plans is increasing, though drug benefits may decrease among MA-Prescription Drug plans

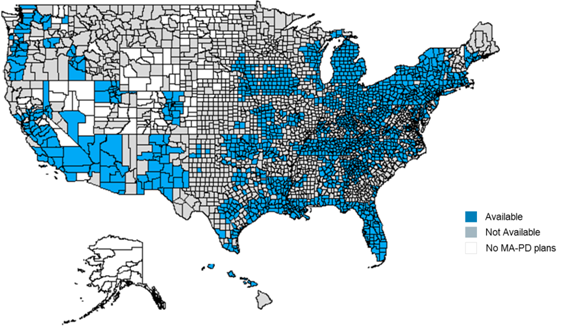

A larger percentage of Medicare beneficiaries will have access to $0 premium MA prescription drug (MA-PD) plans in 2016. Eighty-one percent of beneficiaries will have access to a $0 premium plan in 2016 compared to 78 percent in 2015, further demonstrating the competitiveness of the MA program compared to Medicare Fee-for-Service. As shown in Figure 2, the availably of $0 premium plans varies by geography.

Figure 2: Availability of $0 Premium MA-PD Plans

CMS estimates that the average MA premium will decrease by 1 percent ($0.31) to $32.60. The total number of MA plan options, excluding special needs plans (SNPs), will increase by 3 percent to 1,894 in 2016.

Local health maintenance organization (HMO) plans continue to make up the majority of MA plans – 70 percent – in 2016, increasing 6 percent in 2016. Other plan types, including preferred provider organizations (PPOs), are largely stable from 2015 to 2016. Similarly, SNP offerings, which serve beneficiaries who have Medicaid, certain chronic conditions, or are institutionalized, are stable.

The drug benefits available to MA enrollees may be less generous in 2016 as plans increase deductibles and roll back coverage for drugs in the “donut hole.” Next year, the percent of plans that offer a $0 deductible will decline to 55 percent from 63 percent, and the percent of plans offering additional coverage in the “donut hole” will decrease to 51 percent. Plans could be reducing the amount of these supplemental Part D benefits in order to maintain an overall zero premium.

“These numbers suggest the Medicare Advantage market is strong, despite payment pressures,” said Tom Kornfield, vice president at Avalere Health. “Looking ahead, it will be important to watch if Medicare Advantage enrollment increases more rapidly going into 2016 given the continued availability of zero premium products and the increased number of plans in the marketplace.”

Methodology

On September 21, the Centers for Medicare & Medicaid Services (CMS) released the 2016 Medicare Advantage (MA) and Medicare Part D landscape files. Avalere analyzed the data to assess trends in plan participation, beneficiary premiums, and benefit designs for the 2016 MA and Part D markets. Avalere analyzes information for unique plan options offered within each market. Avalere excludes information on Cost plans, Medicare-Medicaid plans, and plans offered in the U.S. territories from its analysis. CMS does not include information on employer-group waiver plans, Program of All-Inclusive Care for the Elderly (PACE) plans, or Part B-only plans in the landscape files.

###

Avalere staff continue to be available to offer key insights on MA and Part D changes. If you would like to talk to an expert at Avalere, please contact Frank Walsh at [email protected] or 504-309-5164.

Avalere Health is a strategic advisory company whose core purpose is to create innovative solutions to complex healthcare problems. Based in Washington, D.C., the firm delivers actionable insights, business intelligence tools and custom analytics for leaders in healthcare business and policy. Avalere's experts span 230 staff drawn from Fortune 500 healthcare companies, the federal government (e.g., CMS, OMB, CBO and the Congress), top consultancies and nonprofits. The firm offers deep substance on the full range of healthcare business issues affecting the Fortune 500 healthcare companies. Avalere’s focus on strategy is supported by a rigorous, in-house analytic research group that uses public and private data to generate quantitative insight. Through events, publications and interactive programs, Avalere insights are accessible to a broad range of customers. For more information, visit avalere.com, or follow us on Twitter @avalerehealth.