Close scrutiny of proposed health insurance rates for 2018, along with a new state program to contain rate hikes, has cut more than $100 million from premiums for Oregon consumers. This brings the total in premium cut by Oregon’s rate review program to more than $280 million since 2010.

Oregon’s health insurance rate review program, administered by the Oregon Department of Consumer and Business Services (DCBS), serves as a critical backstop to protect Oregon individuals, families and small businesses from paying unreasonable premium rates. Insurers offering coverage in the individual and small group markets must justify proposed premium rates in writing, showing that they are not excessive and explaining how the insurer is working to reduce costs. These written justifications are made publicly available on DCBS’s rate review website, www.oregonhealthrates.org, and the public has opportunities for input through public comments and hearings.

OSPIRG Foundation contributed to the process of reviewing these rate proposals by conducting an independent in-depth analysis of the rate hike proposed by Providence Health Plan, the state’s largest insurer for families and individuals purchasing coverage on their own. Our analysis highlighted some areas of concern for consumers in the insurer’s justification for their proposed rate—some unique to Providence, others true of other Oregon insurers almost across the board. We brought our concerns to the attention of DCBS and encouraged the public to participate in the rate review process.

Today, DCBS handed down its decisions about 2018 premium rates, and agreed with many of the concerns raised by OSPIRG Foundation, cutting an estimated $100 million in waste and unjustified costs from premiums—including more than $63 million from the Providence rate request.

The biggest single factor in the lower rates is the new Oregon Reinsurance Program, which was established by the state Legislature by House Bill 2391. This program contains premium costs for Oregon families and individuals purchasing coverage on their own by spreading the risk of high-cost insurance claims throughout the broader health insurance risk pool. This leads to dramatic cost reductions for individual health insurance plans at the cost of modest increases for other coverage, including employer coverage.

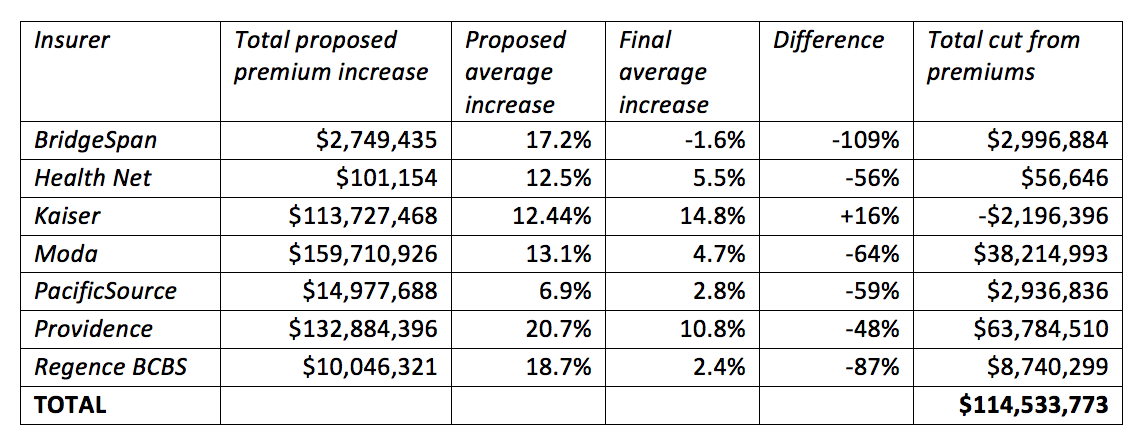

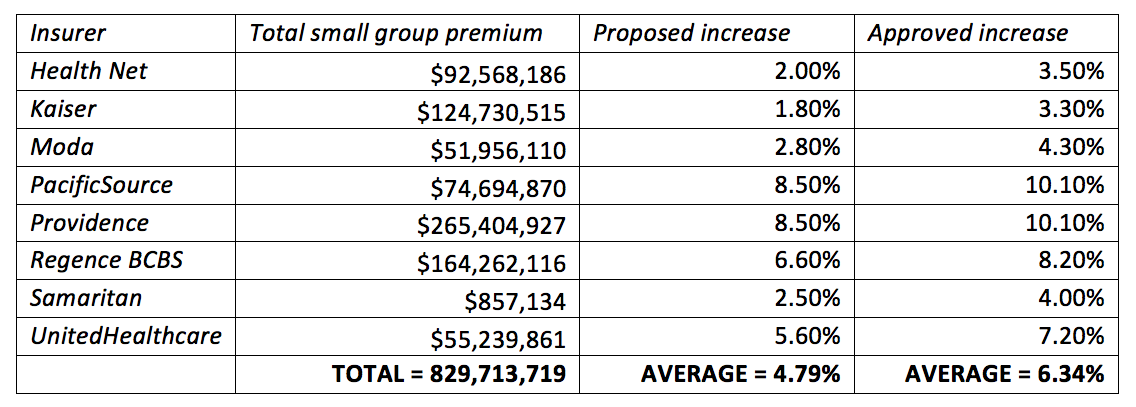

The tables below detail the decisions made for 2018 rates, including the initial proposed rates, the rates approved by DCBS, and an estimate of the dollar total cut out of premiums as a result of these decisions.

The individual market estimates are based on projections provided by the insurers in their rate filings of the total additional premium the company expected to collect from its customers due to the proposed rate.

INDIVIDUAL AND FAMILY RATES

For small employer plans, we used a different method because the data available did not enable the same kind of analysis. For example, some insurers in the small employer market projected that their total premiums would decrease despite proposing a rate increase, making it hard to estimate the difference that an adjustment to the rate would make. To estimate the impact of the rate decisions, we have calculated the total premium for the entire small group market and extrapolated the difference between the average proposed rates and average approved rates. This method is imprecise[1] but still sheds some light on the impact on small employers.

For small employer plans, we used a different method because the data available did not enable the same kind of analysis. For example, some insurers in the small employer market projected that their total premiums would decrease despite proposing a rate increase, making it hard to estimate the difference that an adjustment to the rate would make. To estimate the impact of the rate decisions, we have calculated the total premium for the entire small group market and extrapolated the difference between the average proposed rates and average approved rates. This method is imprecise[1] but still sheds some light on the impact on small employers.

From these numbers, we can extrapolate that the proposed increases would have led to approximately $39,722,544 in additional premium, and the approved increases will lead to approximately $52,583,107 in additional premium. In other words, the decision to raise small group premiums modestly above the requested level will result in approximately $12,860,563 in additional premium. Taken together, then, we estimate that the rate decisions will result in approximately $101,673,210 in premium reduction for Oregonians.

IMPACT ON OREGONIANS

Cutting over $100 million in waste and unjustified costs from 2018 premiums is a big win for Oregon consumers. The resulting savings will make a real difference for Oregon families, making it easier to cover other important expenses. To take just one example, $100 million would be enough for over 225,000 Oregonians to purchase basic adult dental coverage, which is often not included in individual and small business plans.[2]

Cutting $100 million from 2018 premiums demonstrates that increased transparency and accountability works to bring down costs, and shows the profound impact of the Oregon Reinsurance Program.

Unfortunately, this progress is not secure.

One clear lesson from the health insurance rate requests this year is that if the American Health Care Act or Better Care Reconciliation Act pass Congress, or if the Trump Administration takes action to undermine the Affordable Care Act, these rates will be going back up. In fact, depending on the timing of federal action, DCBS may even have to reconsider these rates before they go into effect.

It is hard to estimate the exact impact given the uncertainty about what will happen at the federal level, but Providence estimated that aspects of the AHCA could raise rates at least 9% above the large increase the insurer requested. The insurer also estimates that a Trump Administration decision not to honor the ACA’s cost-sharing reduction payment commitment could lead to additional increases as high as $24 per member per month. Together, these increases could raise rates 15% or more higher. This underscores the high stakes of the debate about the future of health reform for Oregon consumers.

[1] Among other things, it does not account for the fact that the insurers have wildly varying enrollment numbers. Since the variation in proposed rates is relatively modest, however, this should not wildly distort the final estimate.

[2] The average premium for a dental plan available on healthcare.gov for a 40-year-old Portlander is $37 / month, or $444 / year. $100,000,000 divided by $444 is 225,225.

Your tax-deductible donation supports OSPIRG Foundation’s work to educate consumers on the issues that matter, and the powerful interests that are blocking progress.